Bond markets

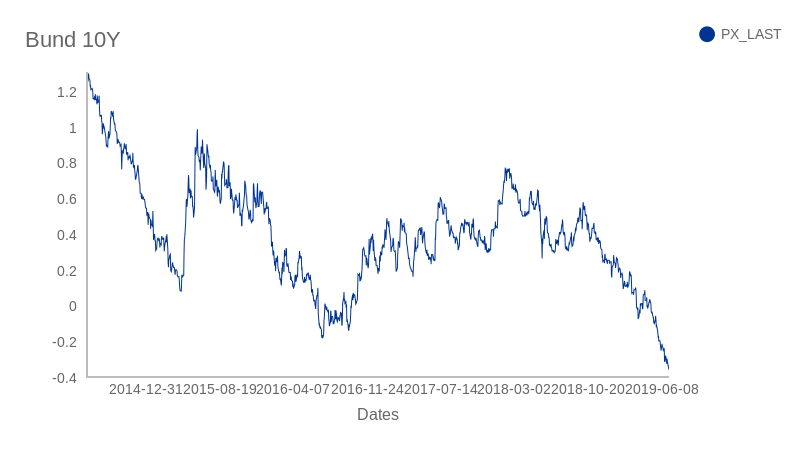

The main driver behind an extraordinary first half of the year 2019 has been an unexpected decline in interest rates. In fact, even the strong performance of the recovering stock markets, which had suffered from big losses towards the end of 2018, were outpaced by the falling interest rates. Just when everyone agreed interest rates could not possibly fall any further, they fell futher, taking the world by surprise. The Belgian Debt Agency proceeded to launch a bond with a 2029 maturity (10 year forward) with an interest rate of merely around 0.13%. This marks the first time that the Belgian government has been able to fund itself at such low cost. Although the return that can be achieved in the next 10 years from investing in this bond is only around 0.13% per year, the demand for this bond was unusually high.

A nuanced perspective on this exceptional situation is required. Firstly, it is important to note that sovereign debt levels are currently very high in many countries. Secondly, there are two economic conditions that are unbearable for highly indebted countries.

One: high interest rates, resulting in a significant increase in the debt servicing cost. As a result, the various governments will have major difficulties paying their interest expenses without resulting in budget deficits. The biggest consequential risk is losing investor confidence.

Two: deflation, which is unbearable in the sense that it slows down, or even reverses nominal and real economic growth. Private individuals, companies and governments may postpone consumption as well as investments. Tax revenues may fall short and, consequently, the debt levels may rise further.

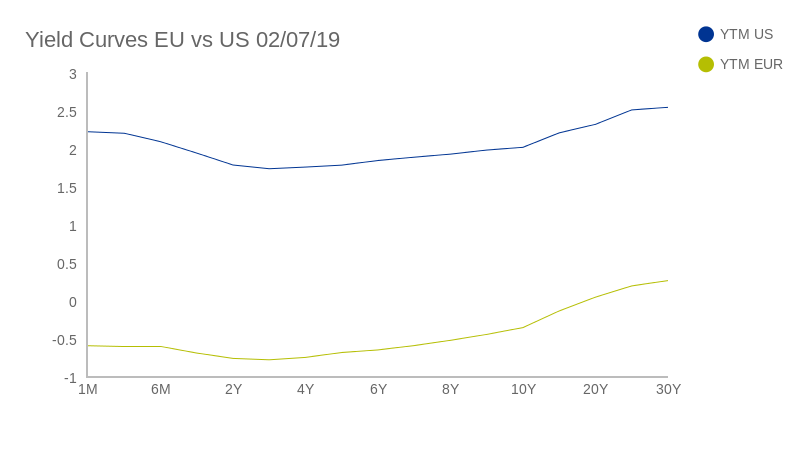

Meanwhile, the central banks seem to be well aware of these dangers. Instead of continuing to raise rates, the US Fed decided to do the opposite. The Fed took this decision in spite of the fact that the US economy is running at full speed and inflation has been stable at around 2% over the recent years. We believe a pause may be required, as perhaps the market may be anticipating too many rate cuts. The situation in the US is, of course, fundamentally different from Europe. After all, US interest rates currently fluctuate around 2%, while they are mostly negative across Europe. The European economy is underperforming the rest of the world. Inflation, Mario Draghi’s primary concern, has dropped to around 1%, requiring all hands on deck to avoid deflation resulting in a further weakening economy. Once more, the ECB has signalled that interest rates in Europe will remain very low for the foreseeable future. This is indeed a controversial approach to boosting European growth and inflation, as negative interest rates can be deeply unfavourable to the economy.

This strategy will most likely lead to lower returns on many types of investments. Especially for government bonds issued by European countries, real estate, where recent price increases have resulted in rental yields to fall significantly, and savings accounts, with a fixed and legally required positive return of 0.11%. Banks in Belgium are still legally bound to provide 0.11% interest on savings accounts, while they can only reinvest the money at a -0.5% negative interest rate, meaning they now incur the difference as a cost. Consequently, banks will inevitably continue investing in sovereign bonds with negative yields.

Equity markets

Today, the debate concerning equity investments has become particularly interesting. The companies in which we invest are valued at approximately 16 times their free cash flow. Investing in these companies should, theoretically, generate around 6% return (1/16), with half of it being tangible through an average dividend yield of about 3%. The other half is reinvested in the company for further growth. Meanwhile, the 6% return that we speak of is in stark contrast to the zero % bond yields in Europe. The difference between the two, also referred as the risk premium, has rarely been so big, and, clearly, is in favour of equity investments.

Our strategy

Regarding fixed income, we have focused on two main drivers. Firstly, we raised the duration of our fixed income investments significantly over the past year. The decline in yields has, therefore, led to strong returns in the fixed income portfolios. Near the end of June, however, as a result of falling interest rates, we again reduced the duration, which now stands at 5 years on average. The second driver revolves around the relative attractiveness of investments in USD. They yield about 2.5% above investments in EUR, which is certainly appealing. We have therefore invested nearly half of our fixed income investments in USD. This guarantees us 25% more interest income over the next 10 years, which will prove to be a strong protection against the fluctuation of the EUR/USD exchange rate. Hence, we built portfolios with approximately 2% gross yield to maturity with a duration of 5 years.

Within each risk profile, we have a maximum equity allocation. Our investment strategy is bottom-up, with a particular emphasis on in-depth analysis in order to gain thorough knowledge of the companies we cover. During the analysis, we pay extra attention to high quality companies, with high free cash flow generation and robust balance sheets. The stories of these companies are written by the millions of people working within these companies generating ample (free) cash flow, currently at a rate of 6% annualised. A portfolio invested in equity and fixed income offers a high liquidity, which is not necessarily the cash with real estate and private equity investments. Nevertheless, market prices are constantly changing, resulting in an enduring challenge. Volatility can cause unrest for those who are monitoring it. Emotions could eventually take the upper hand and disrupt a gradual long-term investment strategy.

In conclusion, a quote which epitomizes what we discussed above: “Financial markets are a way to direct savings to corporate investments and to rely on the wisdom of the market participants to set a price and make long-term investments liquid”.

The executive board of CapitalatWork Foyer Group SA