The investment landscape has changed drastically in recent months. The spread of the coronavirus has had a huge impact on economic activity around the world. This requires an extraordinary focus and concern for the investments we have made. Our analysts continue to carry out extensive research into the investments we have in our portfolios. In this newsletter we would like to inform you about the latest developments and our investment strategy.

Let us re-examine the trilogy: the health war, the real economy and the financial markets.

1) The health war

The health war is by far the most important of this trilogy, from both a human and an economic perspective. When people do not feel safe, they tend to consume less. That is why consumer and producer confidence has fallen sharply in recent months. Clearly, the urgency of a vaccine is very high. Over 60 pharmaceutical companies around the world are conducting extensive daily research into the development of a vaccine. However, most scientists do not expect an approved vaccine until 2021, at the earliest.

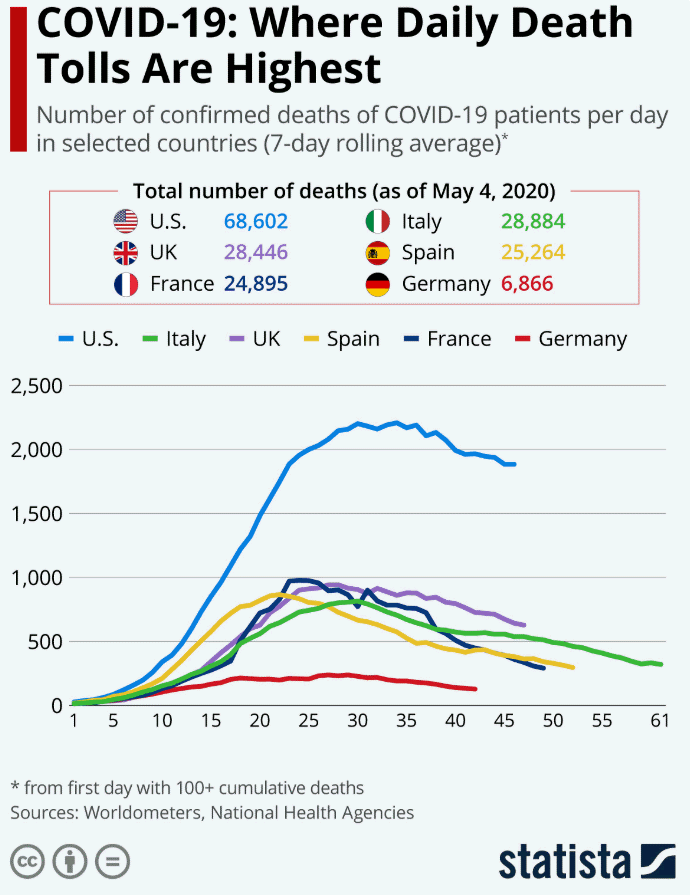

Meanwhile, global government measures for social distancing and lockdown have proved effective in slowing down the spread of the virus. That is the good news about the latest developments in the health war. Governments are gradually easing their lockdown measures and are slowly restarting their economies, but they are staying cautious in order to avoid a second wave of the virus spreading. The flattening curve in the graph below shows that we have made serious progress in the war against this virus.

Source: Statista

Source: Statista

The major Western economies appear to have passed the worst phase of transmission. The peak is now a month behind us. The number of fatalities, with a two-week delay, is now also falling worldwide. Ever more people are being tested and increasing numbers of people are being treated successfully. Pressure on healthcare also seems to be stabilising. But we remain alert as Latin America and countries such as Japan, Singapore, and India experience their first major infection waves.

Although most scientists expect an approved vaccine in 2021 at the earliest, an earlier approval in 2020 would be a major breakthrough. Imagine the euphoria that this would bring to the world and our economies.

2) The real economy (Main Street)

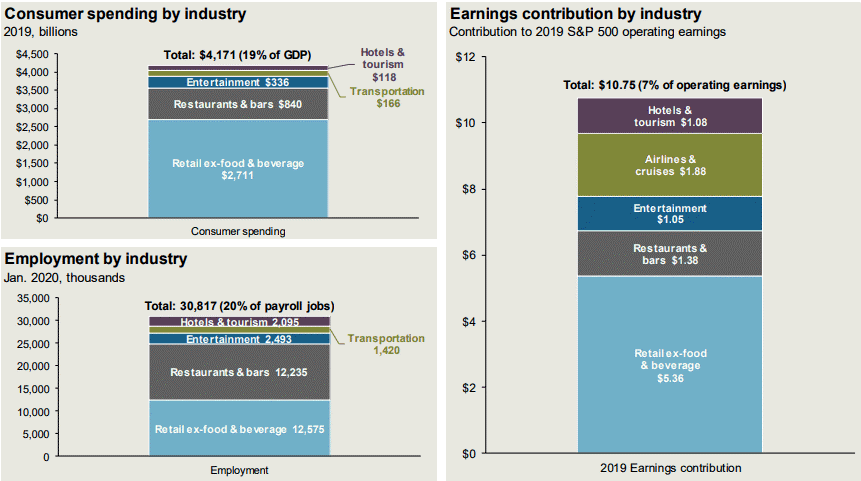

Now let us look at the second part of the trilogy, the real economy. We are gradually winning the health war, but the economic damage is huge. After almost two months of lockdown, our economies are gradually starting up again. Some sectors, such as tourism, airlines and entertainment, will emerge more slowly from the lockdown and need an ‘unconditional victory’ over the health war. These sectors represent 7% of the operating profit of the S&P500. But given that 20% of jobs are represented in these sectors, this will take a heavy toll on the economy.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

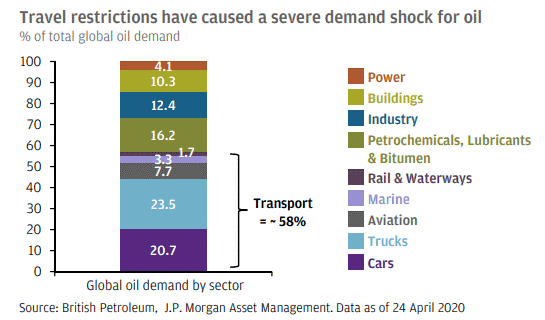

Another sector that is seriously affected is the oil industry. Oil demand has fallen dramatically. The imbalance between production and the demand for oil is estimated at 20 to 30 million barrels per day. With a weight of 58%, the impact of the transport sector on the drop in oil demand is enormous. On the other hand, this low oil price is a huge windfall for consumers and businesses worldwide and leads to lower production costs. Ideally, oil prices should be around $40 to reduce the headwind for the oil industry. A price of $40 seems to be the ‘sweet spot’ for the global economy.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

In conclusion, we can say that these sectors will have to participate fully in an economic recovery before we return to normal. There is every reason to believe that this will take time. This is conditional upon an ‘unconditional surrender’ of the virus or the advent of a vaccine. But, under those conditions, an economic recovery could occur more quickly than expected. Although it currently may seem far away, a post-coronavirus world might be far more robust than we now dare to think, with positive long-term effects.

3) The financial markets (Wall Street)

Let us now evaluate the third part of our trilogy, the financial markets. Policymakers have acted extremely resolutely. Monetary and fiscal stimuli surpass anything we have seen in recent history. Governments’ willingness to help is unprecedented, and the Central Banks are acting at a pace and scale never seen before. After the financial markets reached a low point on 23 March of this year, these far-reaching measures have led to a spectacular recovery in the financial markets.

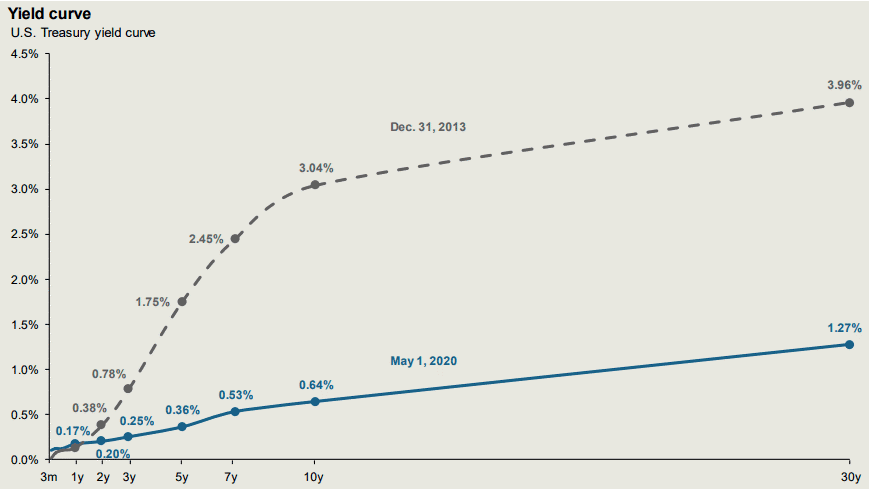

a) Risk-free interest rate

Let us start our tour of financial markets with the risk-free interest rate. This forms the basis for the valuation of all cash-generating assets. And the lower this interest rate, the more favourable for the current valuation of shares. Since the beginning of this year, the risk-free interest rate has fallen by approximately 125 basis points. This provides strong support for the valuation of all cash-generating assets.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

b) Unconditional support from the Central Banks

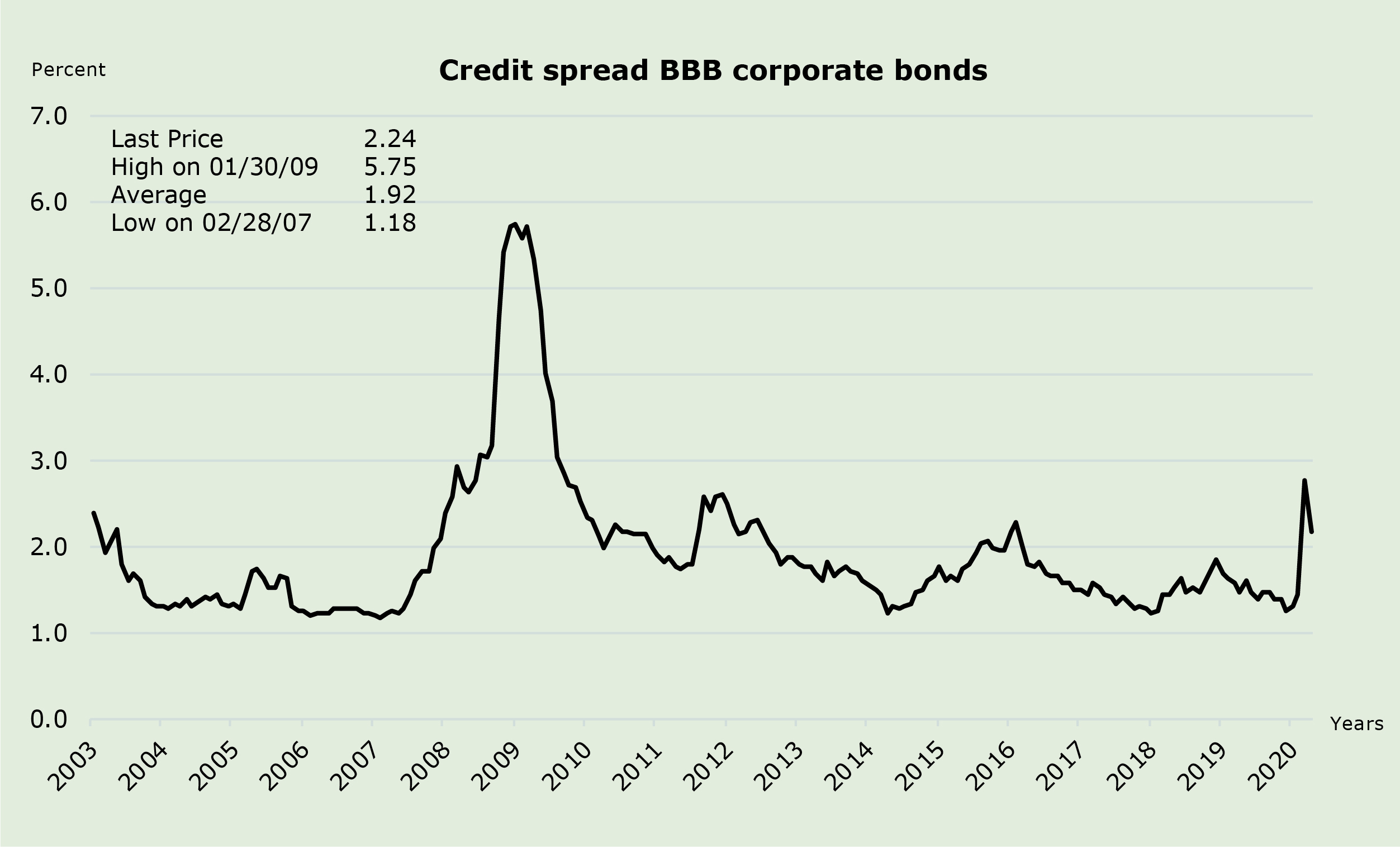

The all-in or unconditional support of the Central Banks has provided recovery and stability in bond markets. Corporate bond spreads are 100 basis points higher than at the beginning of this year, but 50 basis points lower than the peak on 23 March (see graph below). And as the graph below shows, spreads are significantly lower than at the time of the financial crisis in 2008. The importance of this cannot be stressed enough. In addition, the increase in credit spreads is offset by lower risk-free interest rates.

Source: Bloomberg

Source: Bloomberg

c) Valuation of the stock market

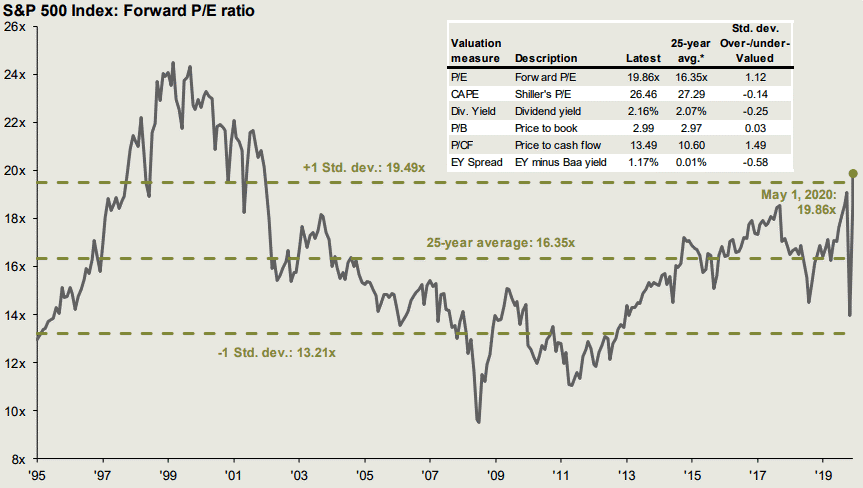

A commonly used measure of stock market valuation is the price/earnings ratio. The so-called forward P/E, which looks at the estimated profit for the next 12 months, is currently 20 (S&P500). It averaged 16.3 over the past 25 years. In the first instance, this may seem on the high side.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

However, it still needs some clarification. First of all, the risk-free interest rate is much lower than in the past 25 years, which justifies a higher-than-average valuation of shares. Secondly, current spreads on corporate bonds also provide no reason to assume that shares would be expensive. Only when credit spreads exceed 300 basis points do shares start discounting negative scenarios. On balance, companies are still able to borrow cheaply, and we can see that this is indeed being used enthusiastically.

What does this mean for our portfolios?

Our portfolios have recovered nicely over the past month. We continue to focus on a comprehensive analysis of the companies in which we have invested, depending on your risk profile, supplemented with the highest-quality bonds. In both equity and bonds, we focus on companies with high free cash flow and strong balance sheets that are able to absorb economic headwinds.

Our key points are as follows:

1/ No oil shares

We are not investing in the oil sector, which has been hit hard by the huge drop in oil prices.

2/ No banks and insurers

We are not investing in banks and insurers, which for years have suffered from very low interest rates in their earnings models.

3/ Low exposure in coronavirus-sensitive sectors

Our exposure in the aviation, travel and entertainment sectors is just 12%. These sectors will need more time to recover from the coronavirus crisis.

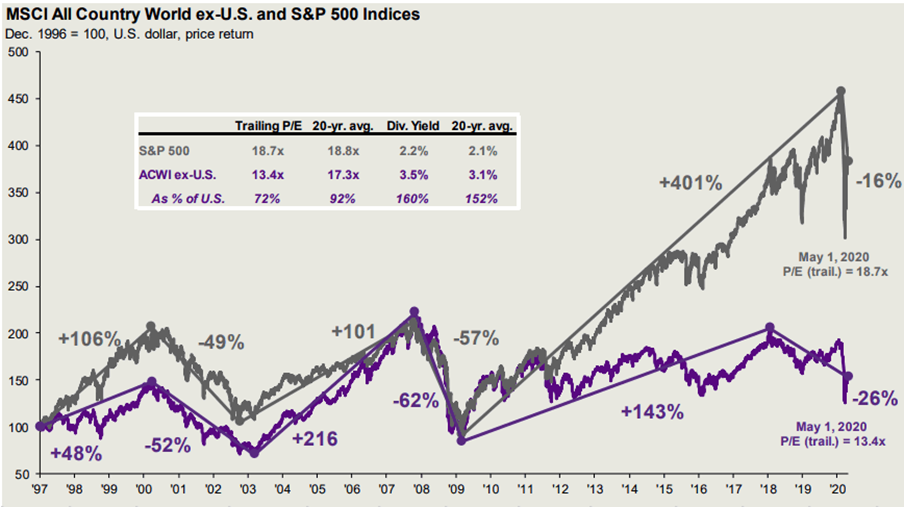

4/ Overweight on the United States

We are 60% invested in the United States, the market that is performing best in relative terms in this crisis. The Nasdaq, the technology heavy index, has even reached break-even year to date.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

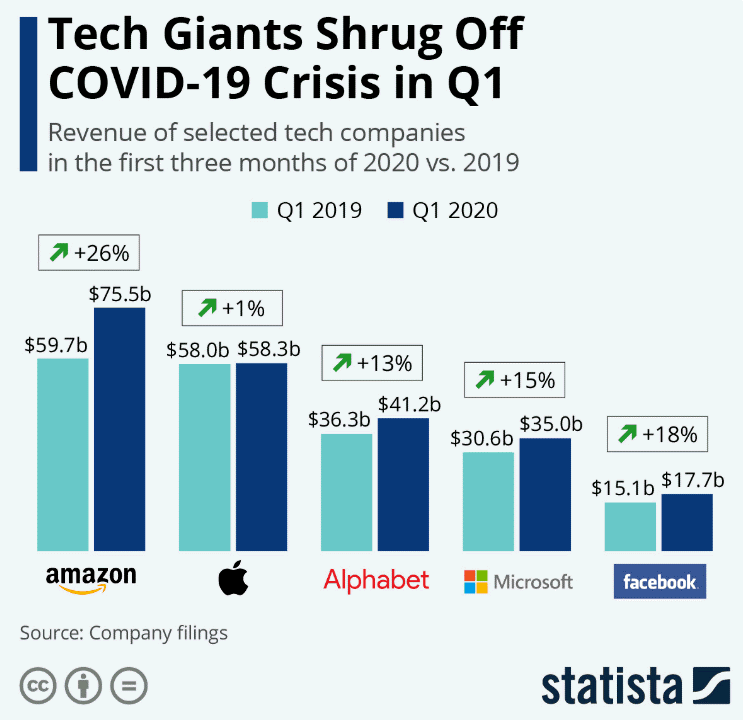

5/ First quarterly figures

The first quarter figures for most companies have now been published. Technology related shares in particular published reassuring figures, and in many cases better than those of 2019. They are well positioned for this crisis. Of course, it is important to know how the figures for the second quarter will look, because it is in that period that the lockdown will be felt the most.

Source: Statista

Source: Statista

6/ Strong balance sheets

Many companies in which we are invested have issued new bonds for record amounts to further strengthen their balance sheets. They have hedged themselves at very low interest rates for the coming years to be even more resistant to any headwind. Better safe than sorry. This gives us a strong sense of comfort and confirms the solidity of these companies.

7/ Diversification

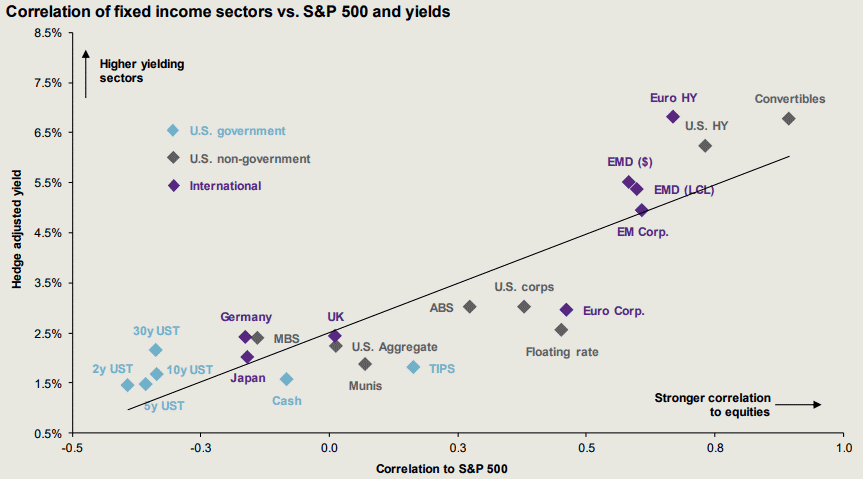

For those who have invested in bonds as well as equity, diversification has worked well. Government bonds have a negative correlation with shares, as you can see in the graph below. This actually acts as a buffer against falling share prices. That is why we invested most of the bond exposure (approximately 60%) in safe government bonds.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

Conclusion

It is too early to estimate the real impact of the coronavirus on economies and corporate profits.

The second quarterly figures that will be published in July will give a better picture of this. The sooner the virus is contained, the sooner a recovery will occur, especially if we consider the enormous relief packages from the Central Banks and governments that can accelerate recovery.

Today, we continue to prefer companies with strong balance sheets and a high free cash flow, which will weather this storm and may even emerge stronger when weaker companies have lost out.