Find below the analysis of our Chief Investment Officer, Erwin Deseyn, on the current market situation and the measures taken by CapitalatWork. You can also watch his latest video, available in french and in dutch where he explains our point of view

1. A more brutal shock than expected

Financial markets are shocked by the US “Liberation Day”.

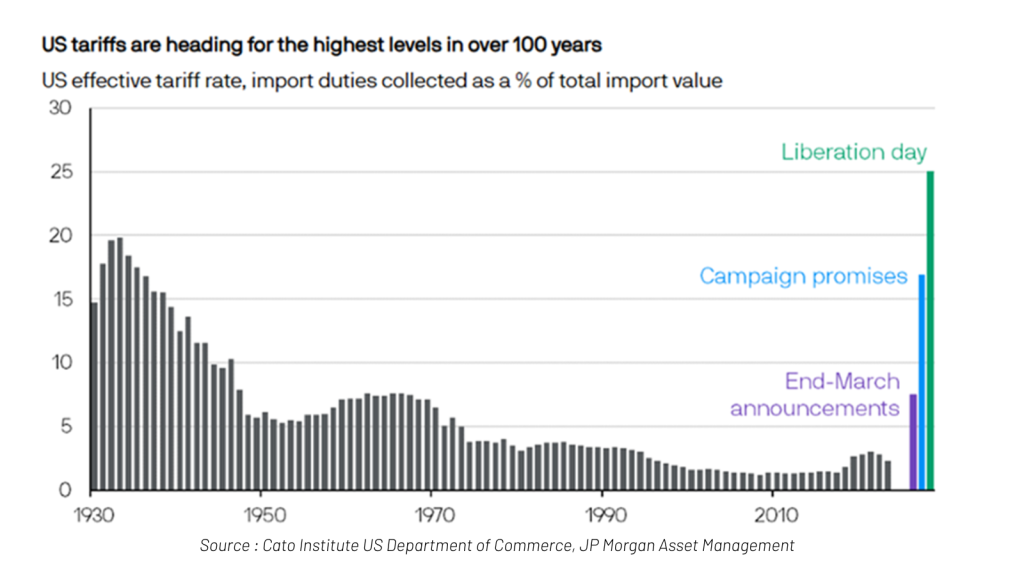

- The tariff war is getting way out of hand.

- The announced tariffs are much higher than expected.

As shown in the graph hereunder, US tariffs are reaching their highest levels in 100 years.

2. Two major fears dominate the minds

We could elaborate whether the arguments used make sense or not.

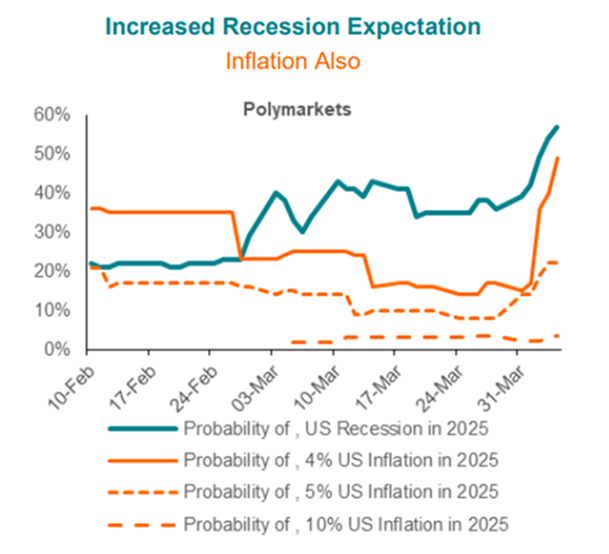

Investors worldwide fear in essence:

- a recession in the US, and elsewhere on the globe as well,

- a surge in inflation.

3. What are the implications for your portfolio? How do we cope at CapitalatWork?

Within Fixed Income we implemented several important derisking strategies already in the first quarter:

- we reduced the duration of the portfolios to 4 years (fear for inflation),

- we reduced the exposure to corporate bonds to 40% (fear for recession),

- we raised the exposure to inflation/linked sovereign bonds to 40% (fear for inflation),

- we reduced the net USD exposure importantly to 10% (the end of US exceptionalism).

The major adjustments within the equities strategy were already implemented in 2024. They can be summarised as, in contrast to ‘passive’ investments:

- we are invested for 50% in US enterprises, rather than the 70% within the MSCI World Index (end of US exceptionalism),

- we are invested for 6% in the Magnificent 7, rather than the 25% within the MSCI World Index (not the end of the Magnificent 7, but these companies were valued as too expensive, as their prices dropped importantly some of them have become interesting again).

In addition it is important to note:

- a considerable part of the portfolio is invested in companies that are active domestically (telecom services, construction, media, … ),

- another considerable part is invested in companies active globally, but produce globally as well (breweries, chemical industry, advertising, … ),

- a substantial part is invested in the services industry, and are not exporting/importing goods,

- a few industries are currently exempt from tariffs, like pharmaceuticals or semiconductors,

- we are not invested in companies prone for American resentment, or companies that are most vulnerable to the tariff war, nor in the automotive sector.

4. Stay calm, stay invested

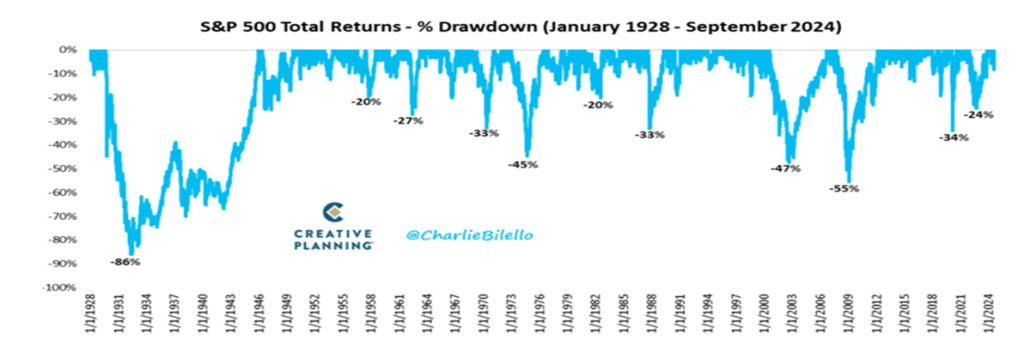

We have always stated panic is a bad advisor. Corrections, even important ones, occur quite often.

It is the price an investor pays for positive returns in the longer run.

So please sit tight.

5. Positive developments are still possible

A few developments may alter the negative sentiment:

- Trump and Xi come to the negotiating table,

- US Congress adopts massive tax cuts,

- Europe and China announce major capital expenditures and stimulate consumption,

- Central banks intervene,

- Energy prices keep dropping.

- Trump is unpredictable and could reverse his decisions while still forcing other countries to negotiate.

Please remember companies in the past were able to adapt to changing circumstances. There is nothing to assume this time it would be otherwise.

Conclusion : Your real enemy is not the recession…

Finally, please remember who the real enemy is to investments. It is not a recession, or temporarily lower corporate profits.

It is not the enterprises in which you are invested through your portfolios, as their balance sheets are strong, while they offer appealing products or services generating cashflows.

… the real enemy is inflation.

Being invested in listed companies offers one of the best solutions to protect against inflation.

Whenever the need arises, we will communicate about future events which may be of importance for your portfolio. And, as always, we are at your disposal should you have any further questions related to the above.