There is uncertainty but also opportunity in the financial markets.

1. Your assets are being managed at what is an uncertain time. Geopolitical developments continue to surprise, with the recent developments in Russia being the latest unexpected twist. It is impossible to predict which direction things will go in Ukraine. But even if this might mean an acceleration of the end of the war, geopolitical relations will continue to have an impact on the financial markets. The consequences are far-reaching. Today, it is important, as investors and Europeans, to stop viewing the globe as if we are the centre of the world map. Regrettably, Europe is slowly but surely being pushed to the side of the chessboard on the geopolitical stage. It is in the Southeast China Sea that the interests of the two major power blocs are clashing.

Relations between China and the United States have been sub-zero for many years. As a result, this situation inevitably also opens up an opportunity to see this relationship improve. There is even an argument to be made that relations between the two have been improving recently. Regular high-level contacts have resumed, championed by the meeting between Blinken and Xi Jinping in Beijing. It’s also possible that Xi will visit the United States in the autumn on the occasion of the APEC conference in San Francisco.

2. The development of inflation and the central banks’ reaction to it is also creating uncertainty. However, it is undeniable that inflation has cooled down considerably in recent months. Consequently, the discourse of the Fed and the ECB is slowly becoming more tempered. There are a few more interest rate hikes to come, but the end of monetary tightening seems to be in sight. This uncertainty regarding the evolution of interest rates weighed heavily on equity and bond prices in 2022. That there is an end to the uncertainty of the extent of possible further monetary tightening is coming our way, is positive news. It opens up a great opportunity for bond investors, who are getting a decent return for the first time in a long time. Those who are simply leaving their money in a savings account today should realise that they are pushing aside a lucrative alternative. After all, a nicely diversified portfolio of bonds has returns that are at least 3% higher.

3. The equity markets have had a strong first half of the year.

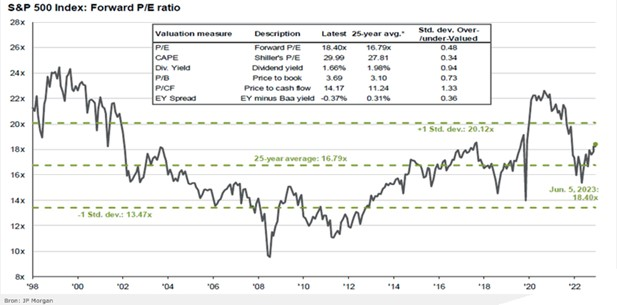

However, what is the outlook for the second half of the year? Let us start by looking at the valuation of the main gauge, the S&P500. Investors today pay 18 times the earnings of those 500 companies. This valuation offers little guidance and is a source of uncertainty regarding the performance of the stock market in the second half of the year. After all, 18 times earnings is not cheap, in fact it’s rather on the expensive side, as you can see on the chart below.

However, averages can hide an underlying reality. Driven by the hype of artificial intelligence, among other things, the share prices of Microsoft, Apple, Google, NVIDIA, Amazon, Meta Platforms, and Netflix, have soared. These “Magic 7” have become expensive. You pay 34 times their earnings. Together, they represent almost 30% of the S&P500. These 7 megacaps are well positioned, have a very strong balance sheet, and generate masses of cash flow. Their share price may continue to rise even though the bar is already high. However, the stronger message lies in the valuation of the 493 other companies. The average valuation of those companies is just 13 times earnings. It is not expensive. If we look at historical returns, investors who bought the stock market at that valuation have made handsome returns. Moreover, the valuation of European companies is also 13 times earnings. The pool of companies with very reasonable ratings from which to fish is particularly large.

4. There are three engines at work generating returns for your assets: asset allocation, security selection, and active management.

a) If we look at asset allocation, the big decisions, we have nothing but good news. Regardless of your risk profile, with many or few bonds, and many or few equities, your prospects for a mixed portfolio using both building blocks are sensitively better than 18 months ago. That’s just common sense. After all, interest rates are significantly higher, and equity market valuations (abstracting from Magic 7 for simplicity’s sake) are promising.

b) When it comes to security selection, the debate today is dominated by comparing between staying invested in the best and most successful companies (Magic 7) or building the portfolio mainly with companies that are much cheaper. At first glance, it looks like an easy debate, but it isn’t, for many reasons.

c) As for the third engine, active management, we can also reassure you. We check the dashboard on which we navigate daily. This is the dashboard where we link risk-free interest rates, government bond yields, corporate bond yields, credit spreads, breakeven inflation, equity market risk premium, and the valuation of the companies we invest in. It is a dashboard that guarantees we can navigate a steady course, while continually assessing which are the most attractive ports of call.