Given the current turbulence in the financial markets, we believe it is important to let you know how we are dealing with the effects of this event in our investments.

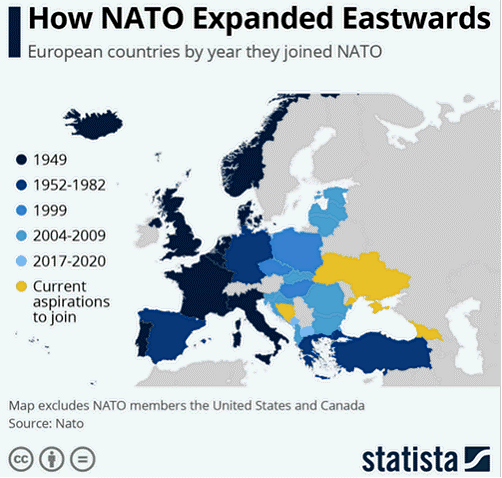

It must have been a very unpleasant awakening for European political leaders. They completely misjudged the developments that led to the Russian invasion of Ukraine. Putin’s annoyance over NATO’s eastern expansion in recent decades has given way to frustration and anger, and ultimately led to the invasion of Ukraine as a whole, rather than just the eastern pro-Russian provinces of Luhansk and Donetsk. The people of Ukraine are now paying a steep price. And Europe – which is already struggling economically and militarily – will pay an enormous price. The Russian people are paying an enormous price as well, as Putin drags them into war and isolation. They are unfortunately headed by a leader who speaks of “denazifying” Ukraine, which is absolute nonsense. It is a war where there can only be losers.

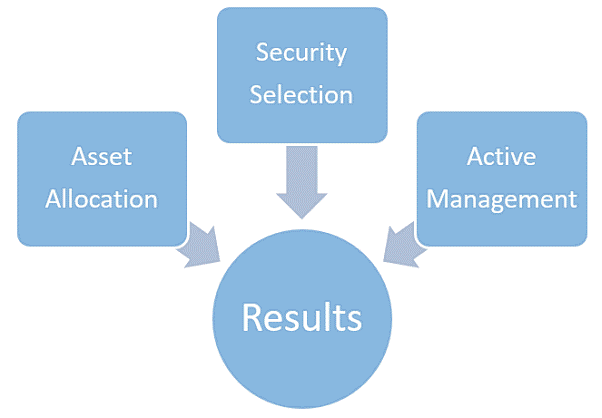

What determines the return on our investments?

The performance is determined by three factors:

- Asset allocation: the distribution of your assets

- Security selection: which shares and bonds we choose to buy

- Market timing: putting ever-changing share prices to work through active management

What can we say about these three sources of return?

I. Asset Allocation

We have made strategic choices in three areas that work to our advantage:

1) International diversification

Europe is vulnerable at the geopolitical level. It is economically vulnerable, partly because of its heavy dependence on Russian gas. It’s also financially vulnerable due to rising public debt. And Europe is militarily weak, owing to its underinvestment in defence over the past two decades. Europe is where we live, and most of us will never break away from it. But what we can do is hold a large part of our investments outside Europe. Approximately thirty-six per cent of our bond portfolio is denominated in euros. Almost half of our bonds are in US dollars. As for our equity portfolio, approximately 28% is invested in euros. There too, it is heavily weighted (approximately 65%) in favour of the US dollar as a safe haven.

2) Protection against inflation

We’ve been in the “long-term high inflation” camp for some time now. We have two natural hedges against inflation built into our portfolios. The first one is a very large allocation (approximately 50%) in inflation-linked bonds. These protect investors against future inflation. They have been working to our advantage for over a year now. Secondly, we are invested in shares of companies with “pricing power” – companies that have proven time and time again that they can adapt to an ever-changing world. Stock market valuations have already fallen significantly. In Europe, for example, one pays 13 times the company profits. That is a share return of almost 8% (1/13). Even if you skim off 20% of the gains, shares remain relatively attractively valued. The price/profit ratio then rises to 16, giving a return on shares of approximately 6.25% (1/16). These returns are in stark contrast to the negative interest rates that we have been accustomed to in Europe for nearly ten years now. The European Central Bank (ECB) faces a particularly impossible choice. It can either raise interest rates to keep inflation in check, at the risk of further slowing economic growth at a very inopportune time. Or it can elect not to raise interest rates, with the aim of maintaining stability in the economy and financial markets. But the latter is also a weak choice because even more inflation is bad news, especially for the poorer part of the population. Social unrest may follow.

3) Investing without chains

We are active investors. We do not invest in indices, benchmarks or stock market hypes. Our investment process does not oblige us to be invested in Italian government bonds or European banks, for example, since they are simply part of stock market indices.

II. Security Selection

Companies with strong business models and strong cash flow generation

We are invested in government bonds of countries that can survive a debt crisis – bonds from countries such as Germany, the Netherlands, Luxembourg, Australia, Norway and the United States.

We’re also invested in corporate bonds with very strong balance sheets and relatively low debts.

Finally, we’re invested in a well-diversified equity portfolio of some 80 companies. At today’s prices, one pays 14 times the profit for that portfolio, which means a return on shares of approximately 7% (1/14). We are convinced that this equity portfolio is also a good place to seek protection in these uncertain times.

We don’t invest in cryptocurrencies that do not generate cash flow. We don’t invest in equities that were once terribly expensive and have fallen sharply since reaching their top price. We don’t invest in equities that attained Covid hype. And we don’t invest in equities that were victims of sustainability hype.

III. Active Management

Finally, we try to take advantage of the ever-fluctuating prices of the bonds and shares we do invest in. We buy shares or bonds that – based on our research – we believe have fallen too much. And we sell rising stocks or bonds that we believe have become too expensive. These often take the form of small movements. When you add them up, however, this contradictory attitude produces attractive results. Every day, our team of analysts, fund managers and asset managers is constantly working to get the best out of your assets and to protect your assets in the best possible way.

Conclusion

We are invested in asset classes that protect you in the current uncertain environment (asset allocation). Within those asset classes, we’ve selected bonds and stocks that can weather a storm as they generate large amounts of cash flow year on year. Finally, we’re continuously evaluating our investments and responding to them through active management.