Never mind the volatility on the equity markets. Forget about stock prices and their occasionally strong fluctuations. What you have to remember about 2019 is the disappearance of positive interest rates.

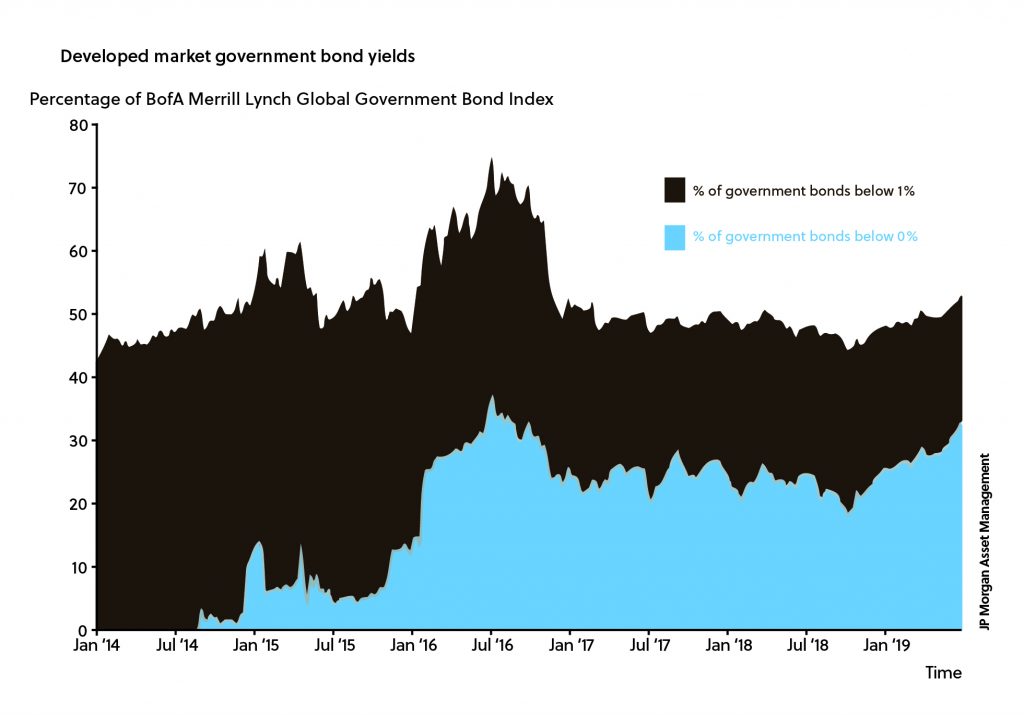

Feel free to compare Mario Draghi and Jerome Powell to magicians who have performed an impressive vanishing trick. They made the “positive interest rates” disappear, as illustrated on the chart below.

As a matter of fact, 30% of existing government bonds now have a negative return, and half of the outstanding government bonds have yields below 1%. The most remarkable example is the yield on a 10-year German government bond: approximately -0.7%. As you may know, this interest rate is the reference point, the benchmark for all other investments in the Eurozone. It is the Eurozone rate that best embodies the concept of “risk-free” interest.

Drop in interest rates

This year, the most influential central banks around the globe have lowered their interest rates, driven, essentially, by the fear of recession. In our opinion, however, the matter of a possible recession being a “sure thing” is far from reality. The US economy continues to perform strongly, and in China and Europe, fiscal stimulus is being prepared in the event that the slowdown continues to worsen.

This brings us back to the key message of this update, the steep drop in interest rates. Because we witness it every day, there currently exists a certain “buying panic” among investors. For generations, investors have been accustomed to attractive yields on their fixed income investments. These have now disappeared in the blink of an eye and this takes a toll on all investors. The panic that ensued has only accelerated the downward trend of interest rates.

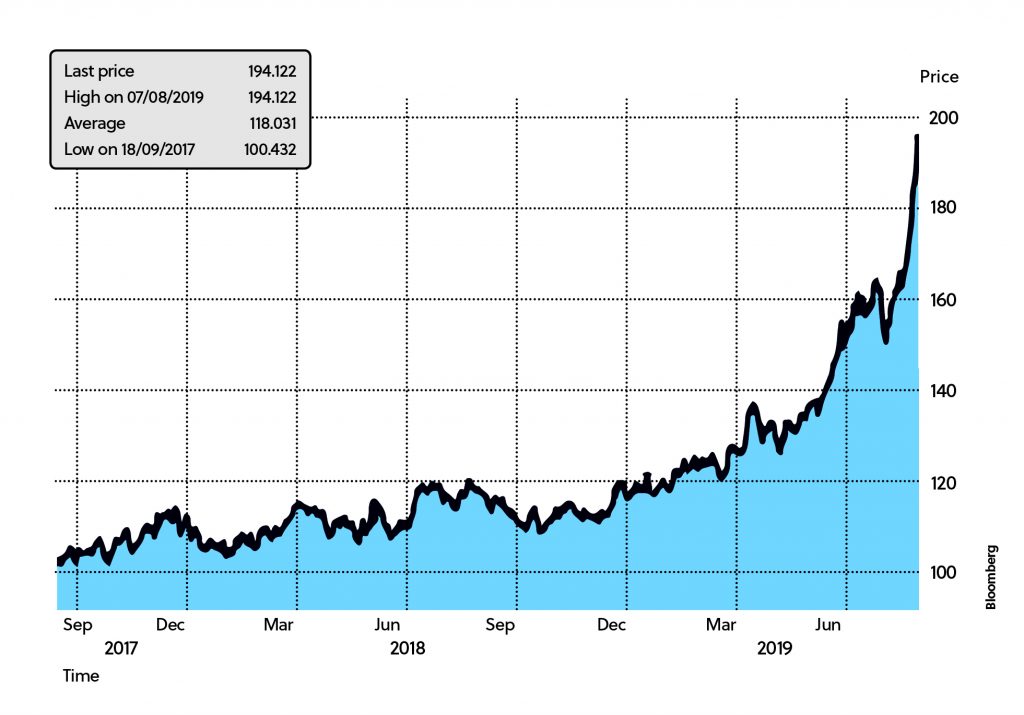

More specifically, these low interest rates have pushed investors towards bonds (quickly wanting to lock-in that little bit of positive yield) and also towards alternative investments such as real estate, gold, private equity, etc. As a result, these prices have also risen sharply, with the inevitable inverse effect of low expected returns. Indeed, falling interest rates increase the prices of all investments. Just look at the rate of the 100-year Austrian government bond below, which has risen by 88% this year due to the sharp drop in interest rates.

Equities are valuable

This year’s 15% rise in equity markets pales in comparison. Today, with interest rates that, will probably remain low for a very long time, equities as an investment are highly VALUABLE. The profitability of the companies amounts to an average of 6%. Half of it (3%) is highly tangible, as it is distributed annually as a dividend. Investors would certainly rush to high-quality bonds, should they offer similar yields.

What investor would ever sell his equity portfolio in a world dominated by negative interest rates? Whether it be fear for an upcoming recession, Brexit or trade war, corporations have been known to be flexible and to adapt to changing circumstances, thereby protecting equity investments. Even lower rates, resulting from the next recession, surely wouldn’t help your financial planning. But, what if savings accounts would generate negative yields? Then what? The hunt for yield would only intensify and shares in solid corporations would only become MORE VALUABLE!

Naturally, you have to take into account your personal situation, your prioritary objectives and your investment horizon which will all eventually determine a risk profile that is suitable to you.

Yours faithfully,

The Management of CapitalatWork Foyer Group