After an impressively strong first half of the year, markets took a breather in the third quarter. The investment community had to thoroughly rethink its future projections because of a number of fundamental and interconnected shifts in macroeconomic, monetary, (geo)political and corporate economic parameters. Let us take a moment to go through these.

Economy: fasten your seatbelts!

Investors found little to be cheerful about in the economic news during the summer months. It was especially the growing signs of a slowdown in US growth that gave cause for concern. Indicators from the labour market, the production side and consumption unanimously pointed to an economy in slowdown. Joe Sixpack, the eternally consumption-addicted American, is indeed having a tough time. His Covid-era savings pot has been emptied, causing him to suddenly feel the full impact of past interest rate hikes and the wave of inflation. This is particularly noticeable in the sharply rising figures for defaults on consumer debt (credit cards, car loans, etc.) and a hardening social climate. The latter is evidenced by the recent labour dispute at Boeing, where workers labelled a proposal for a wage increase of no less than 25% as inadequate and promptly went on strike.

Those who had hoped that the impact of the slowing US growth could be somewhat absorbed by a rebound in the Chinese economy have been left disappointed. The measures announced by the Chinese authorities to shore up their sluggish economy proved to be “too little too late”. They were nowhere near enough to prop up the economy that was sliding into a deflationary spiral. The announcement of a new extensive stimulus package by the Chinese central bank at the end of Q3 points to growing government frustration with the absence of an economic recovery. But the question remains whether this will be enough to revive the economic engine. Europe seems completely incapable of breathing new life into an economy that has long been dragging its feet. Indeed, the malaise affecting the once-mighty German industry only seems to be deepening.

Monetary policy is finally moving in a different direction

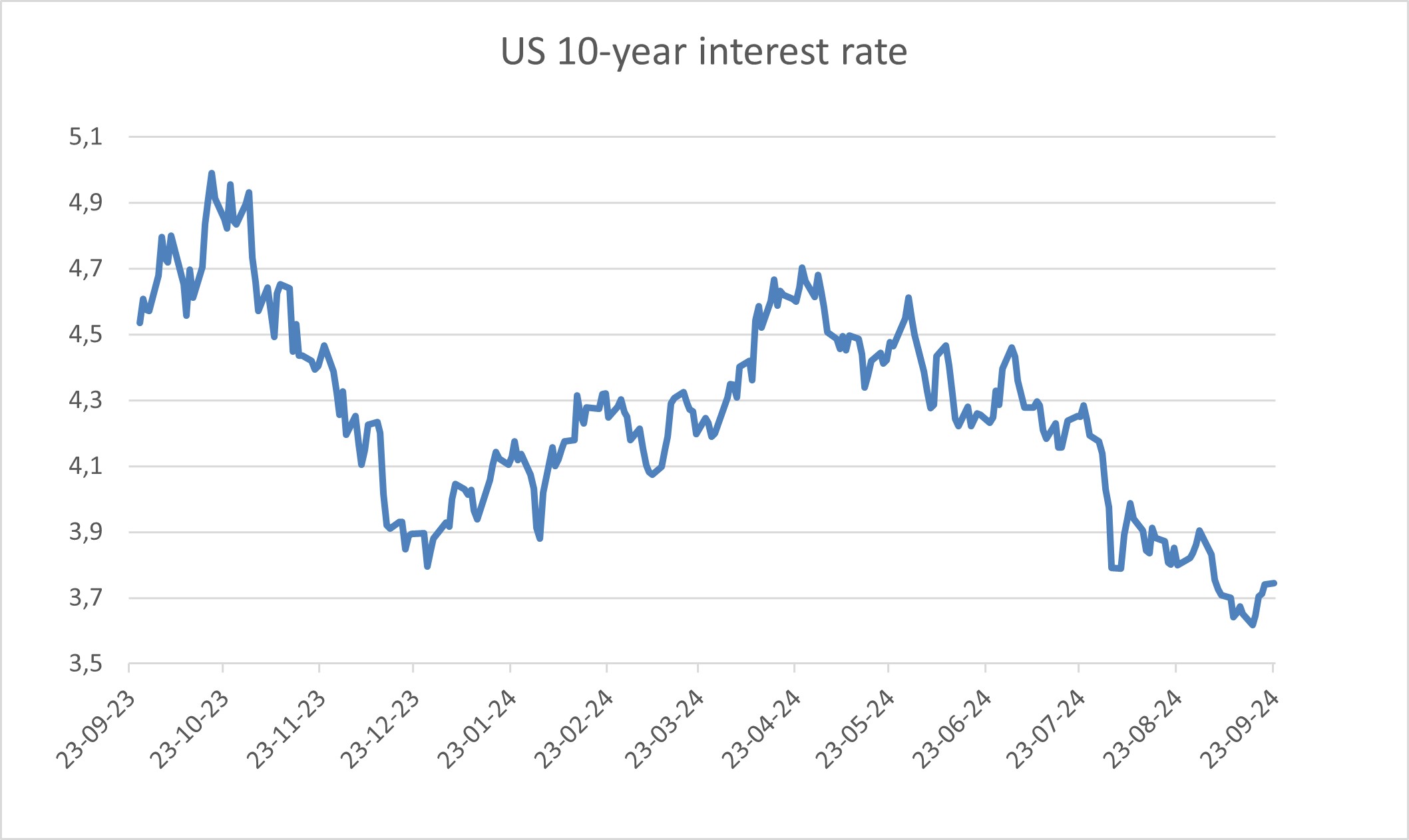

Needless to say, the growing indications of a weakening economic environment have certainly had an impact on the bond markets. Markets, which at the end of June had all but given up hope of a quick interest rate cut in the United States, quickly changed their stance. Pressure on the FED (US central Bank) to support the economy by lowering the interest rate steadily intensified. The slowly falling inflation figures gave this call for a lower rate even more credibility. The persistent fall in the long-term rate (see graph below) showed how much the expectation of a fall in the rate had gained momentum. FED Chairman Powell eventually relented and finally the FED cut the rate by a substantial 50 basis points. The ECB (European Central Bank) also reduced its rate by 25 basis points. This move appears to mark the beginning of the long-awaited journey towards lower policy rates.

One country that rowed against the tide of lower interest rates was Japan. The country actually raised its rate; the first time in 17 years! However, the higher Japanese interest rate triggered a financial chain reaction that sent a shockwave through the markets. Many speculative market players had taken out massive amounts of cheap Yen loans and converted the money raised into investments in higher-yielding currencies or equities. The narrowing interest rate differential forced them to unwind these positions, leading to the sale of tens of billions of positions in a short period of time. This unwinding of this “yen carry trade” contributed to the sharp stock market fall in early August.

Political consternation in US and France, Ukraine on the offensive

As well as all these economic shifts, investors also had to take account of (geo)political developments. There was widespread consternation in the United States as Joe Biden, after a dismal debate performance, finally conceded to mounting pressure from his party that he needed to step aside for Kamala Harris. This revitalised the Democratic campaign and Harris rapidly caught up with Trump in the polls. That Trump has now escaped 2 assassination attempts demonstrates the rising threat of political violence in the United States and many observers are deeply concerned about what might unfold in the coming months.

In the meantime, another appalling political soap opera was playing out in France. Macron dissolved parliament after his party’s defeat in the European elections and was immediately confronted by an election victory for the united left-wing opposition. Without a workable majority, he must now regain control of France’s shaky public finances. The continuing high interest rate differential between France and Germany reflects the markets’ serious concern about the situation. But the geopolitical surprise this summer was the offensive launched by Ukraine against Russia.

To the surprise of many, Ukraine managed to occupy more than 1,000 km² of territory in the Kursk region. That Ukraine is aiming to force a stronger position at the negotiation table could imply that diplomatic solutions to this prolonged conflict are gradually being contemplated. This cannot be said for the still seemingly hopeless situation in the Middle East, where tensions, on the other hand, are only increasing.

Corporate economic news: back to reality?

As if all these rapid developments in the economic and political environment were not enough for the markets, investors suddenly also became concerned about the potentially excessive way in which they had driven up the valuations of AI cluster companies to great heights. Although the Q2 results published by the Tech giants still met or even exceeded expectations, most were a little more cautious about their future prospects. Whereupon they were treated by the apparently unpleasantly surprised investors to a sometimes sharp fall in prices. This seems to have finally opened the much-needed debate about how the many billions invested in AI should be generating a return. As long as the economic potential of AI technology cannot be gauged on the basis of a clear revenue model, this more critical view from the markets seems entirely justified!

Economic catharsis calls for action!

Clearly the last quarter was marked by fundamental developments that point to a shift in the trend. The long-anticipated journey towards lower interest rates has finally begun. Given the tough economic environment that we will face, we should not immediately cry Hallelujah, but it does make things clearer.

As far as the economy is concerned, it is crystal clear that a period of catharsis has begun, particularly in Europe, in which the mistakes of the past must be addressed. Efforts must be made to restore competitiveness and productivity. The Draghi report on the waning European competitive position clearly demonstrates that a different political path has to be followed than the one taken in the past if we want to do something about this. There will no longer be room for disparate regulatory policies that pursue too many ambitious objectives at the same time. The fact that those European countries that faced the debt crisis over a decade ago now have their finances in order (with the notorious exception of Italy), while the heavyweights of that time (Germany and France) are in trouble, can shed some light on the path to follow. In the meantime, the public is all too aware that this recovery policy is a necessary evil that will require far-reaching and sometimes painful measures, which can help to facilitate this policy politically.

The market also seems to have entered into a period of “soul searching”, with investors coming back down to earth. So it’s high time for a recovery to at least some extent of a sustainable “price discovery” on the basis of fundamental cash generation. With the hype surrounding AI, the signal of free cash generation has indeed been drowned out. The increasing government intervention in economic life has also contributed to this. However, if we want to find a new balance between adequate economic self-sufficiency, social stability and environmental objectives, we will have no choice other than to provide sufficient capital for profitable market-validated projects.

This is exactly the contribution we make as an active asset manager. The past few months have certainly been difficult for Capitalatwork, where we attach great importance methodologically to paying a correct price. This is not the first time that the investor community has miscalculated by heavily investing in companies with impressive growth that later appeared to be too expensive. The future will tell whether this has once again been the case. Many point out that the situation is now very different from the technology bubble in 2000. But who was it who said that the most dangerous words in financial circles are “this time it’s different”?